Wind-power prices have reached record lows. For utilities and corporate buyers interested in buying clean, renewable energy, now is the time to buy. But what about the southern U.S.? Will utilities to the east of Texas act quickly enough to participate in the wind-energy boom?

“Record lows” might not quite convey the stunning contract prices for wind power. A study recently completed by Lawrence Berkeley National Lab shows power purchase agreement prices in the $20 MWh range for new wind-farm projects. In a separate analysis, Lazard Associates have shown wind power prices have plummeted by 61 percent in just five years.

These low prices have become so attractive that previously skeptical utilities in the South are contracting for a substantial quantity of wind power. Wind developers are also taking advantage of new technology and taking a second look at developing projects in the South.

Opening the Southern Market

Turbine technology improvements have driven down project costs and created a renewed interest in wind-energy development in the South. Taller turbines with longer blades are better suited to reach high wind speeds and more effectively convert that power into electricity. That’s good news for the South, where economic development of wind farms seemed difficult just five years ago.

The South is benefiting because stronger winds tend to be located a bit farther up from the ground than in other regions. For an overly simplistic analogy, consider the wind’s effects on a sailboat: A taller mast with larger sails is capable of collecting wind that might not be available at the water surface. It should be no surprise that a major wind-turbine manufacturer, Vestas, also dabbles in sailboat racing.

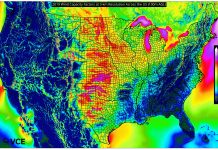

Independent analysis by the National Renewable Energy Lab suggests that with current, modern wind-turbine technology, the South may contain hundreds of gigawatts of wind-power potential with capacity factors more than 35 percent. Wind-farm development companies are actively prospecting new projects in every state in the South. Substantial quantities of wind power from other regions are already flowing into the South due to improved economics of new turbine technology.

Wind Power Enlightenment

It isn’t just the new technology that is opening up the South to wind development. Utilities also are becoming savvy to wind-power markets.

An emerging challenge to southern utilities is the need for “winter-peaking” power. With increased efficiency of HVAC equipment and a recent trend towards “polar vortex” events driving exceptionally high winter-morning demand, utilities are increasingly planning for both summer and winter peaks.

Fortunately for wind developers, “polar vortex” events don’t just drive demand, they are also windy, and at a time when wind turbines generate at their highest performance levels. Low cost wind energy from the interior states and Upper Midwest, coupled with transmission wheeling charges, have become so cost competitive, that a number of utilities are voluntarily purchasing wind power. More than 3,800 MW worth of wind energy contracts already have been signed with utilities in the South.

The Southeastern region is dominated heavily by vertically integrated utilities and regulated markets. Unlike other parts of the country, where state policy helps drive wind-power development, southern states do not have aggressive renewable energy mandates. Nevertheless, southern utilities are also becoming more familiar with the wind market. In addition to purchasing wind-energy resources, some utilities’ sister companies also develop, own, or operate wind-power projects across the country. Three of the largest utilities in the South — Southern Company, Duke Energy, and FPL — are affiliated with major renewable energy development companies. In the case of Southern Company, its unregulated affiliate has prospered by owning wind projects, while its regulated affiliates have entered into wind contracts.

An Opportunity and a Challenge

Even though most large southern utilities have gained familiarity with wind power, they are not finding it easy to engage the wind market. For example, because wind-turbine technology (and the corresponding economics) continues to advance so rapidly, utilities are struggling to keep their planning and procurement practices up-to-date.

Even today, many southern utilities study wind opportunities as if there is a single prototypical project to purchase. But the wind market is more complex than, for example, the natural gas peaking power plant market. Multiple wind-energy opportunities exist that have varying costs, performance levels, and contractual options. In some cases, integrated resource planning software lacks the flexibility to truly account for the diversity in wind-energy options.

But in some worst-case examples, resource planning can rely on data from a decade ago, or it assumes wind-energy resources must be within a narrow service territory footprint. Even more common are planning studies that routinely assume the utility would “self build” wind-farm projects. Of course, in reality most wind capacity is contracted from wind developers under long-term, fixed-price energy contracts. Gradually, some utility planners are identifying nuance and incorporating a number of wind-energy options to better evaluate near-future plans.

Southern utilities are, in fact, the beneficiaries of a robust and diverse wind market. One option is to import wind energy from regions with regional grid operators such as the Southwest Power Pool (SPP), the Midcontinent Independent System Operator (MISO) or the Pennsylvania-New Jersey-Maryland Interconnection (PJM). Utilities are also actively negotiating with wind projects with delivery via two high voltage direct current (HVDC) transmission projects. And, as mentioned previously, developers are expanding efforts to develop in-region wind-energy resources.

Importing wind energy from regions with regional grid operators has been the preferred purchase method for southern utilities. Utilities including Alabama Power, Appalachian Power, Arkansas Electric Cooperative Corporation, Georgia Power, Gulf Power, Southwestern Electric Power Company, and the Tennessee Valley Authority collectively hold more than 3,800 MW worth of wind-power contracts. Most contracts are served from wind-energy-heavy states such as Kansas and Oklahoma in the SPP grid system. Wind-energy purchases from northern MISO states and Texas are also taking place. Despite the variable transmission charges (and even sometimes wheeling charges across both the SPP and MISO interfaces), the high capacity factors and low price of wind power is extremely attractive for southern utilities.

Wind power can be delivered via HVDC transmission with lower costs, higher capacity factors and capacity value, coupled with a fixed long-term transmission rate. In order to access some of the best wind-energy resources in the country, while addressing transmission costs and constraints, two proposed HVDC transmission projects are planning to connect directly to customers in the South. The Plains and Eastern Clean Line and Pattern Energy’s Southern Cross would collectively provide 6,500 MW of capacity from Oklahoma and Texas to new converter stations in Arkansas, Mississippi, and Tennessee. Both of these projects could be online delivering power in the 2020-2022 timeframe. Transmitting wind energy via HVDC power lines are unique resources that need to be evaluated in addition to other wind-energy opportunities, but considering their distinct characteristics.

Although utilities have tended to demonstrate little interest in local wind resources, new turbine technology effectively opens up the South as a new market for wind-farm development. Now, each state in the South contains thousands and thousands of megawatts of wind-power potential. In-state or in-region wind resources are likely to have lower capacity factors, and higher installed costs, compared to other wind-energy opportunities. Yet, the associated economic benefits, as well as reduced transmission considerations, may prove extremely attractive to southern utilities and corporate purchasers. In fact, the first utility-scale wind project in North Carolina is under construction and has secured a long-term contract with Amazon Web Services.

Time is of the Essence

For utilities and corporate purchasers interested in purchasing wind energy, now is the right time to buy. In late 2015, the United States Congress passed a long-term extension and phase-out of the federal Production Tax Credit (PTC). Wind-farm development companies can qualify their projects by expending a small amount on the total project costs. Qualified wind-farm projects have four calendar years to come online and generate power. However, each year that a wind farm’s commencement of construction is delayed, the PTC value declines by 20 percent. In order to qualify for a full-valued PTC, developers need enough assurance from utility and corporate purchasers to justify expending project costs and safe harboring a project’s PTC status. Waiting to start construction on a wind project could result in millions of dollars in lost savings because of the PTC phase-out.

A number of utilities in the South have issued requests for proposals or information (RFPs) regarding renewable energy, including wind energy. Notably, utilities have announced requests for at least 2,100 MW of renewable energy over the next few years. To secure the lowest cost wind-energy prices, utilities and corporate buyers need to move swiftly. Customers that are capable of moving quicker are more likely to attract the best wind-energy projects. For utilities that have overly restrictive RFP requirements or excessively long approval timelines, the pool of qualified wind-power projects may naturally winnow themselves in favor of quicker, more promising buyers. Slow, restrictive RFPs could end up with higher cost proposals, or risk losing value due to the PTC phase-out.

Utilities and corporate buyers can attract the best wind-energy proposals by incorporating flexibility and allowing diversity. Diversification of wind-energy project location including in-region, nearby grid operator markets and HVDC transmission options is also important to evaluate the real and multiple market opportunities. By engaging in diverse and thoughtful wind-power procurement expeditiously, utilities and corporate buyers can minimize risk while maximizing wind-power opportunities.