Thousands of sensors embedded in wind turbines send out terabytes of data. Making sense of that data and transforming it into useful information to drive energy production is a task that more and more wind-farm managers are looking to take advantage of.

Insights are the useful information created from that data, and that is the backbone of what the experts at Uptake have been doing for more than four years.

The data explosion is called many things, whether that be the Internet of Things or Grid 4.0. But whatever it’s called, the conclusion is clear: The transition to providing insights is a foregone conclusion.

“The argument became when and how and not if,” said Sonny Garg, Uptake’s managing director for Global Energy Solutions. “We had made a social compact with people to say we’re going to provide safer, reliable, affordable, and increasingly clean energy to everybody.”

Working for wind

In the wind industry, the bottom line is increasing energy production, decreasing costs, and improving safety, according to Garg.

“Digital strategy and the adoption of industrial AI have to be grounded in specific metrics that drive the business,” he said. “Because we are delivering insights, that is going to move that metric favorably for you.”

Because Uptake is a young business, it’s been able to come at its customers with fresh approaches to creating the insights necessary. And with that, it became a great fit for wind, according to Garg.

“We have purpose-built from the very beginning a machine-learning AI platform,” he said. “And what’s important about that is that we were fortunate with regard to timing. We didn’t have any technical debt. So we weren’t GE, who had built a lot of separate software and tried to use that to build something new. Or even C3 [IoT] that started out trying to be a carbon trader and ended up trying to do grid analytics and then tried to be a platform company.”

The core idea behind Uptake was to do data science and machine learning, and everything else would be built around it, according to Garg.

“There was nobody else who had done that,” he said.

In order to help customers maximize the potential of what Uptake can do, a clear plan of what the data represents must first come into play, according to Garg.

Assembly line of data

“You start first with what are you trying to achieve with the data,” he said. “Think of it like Uptake has built a manufacturing plant. You need to start out with, ‘what are we manufacturing?’ Well, we’re manufacturing insights that are going to improve your business. So, what I want to do is manufacture insights that are going to improve annual energy production for a wind company. Some of those could be around predictive failures of major components, your gearbox, other elements of your drivetrain, your generator, or it could be around power performance. Am I actually producing as much as I could? Those are the kinds of insights that are tied to an outcome. Then you go back and look at the data needed to provide that insight. That’s how we think about it.”

Everything in between that data and the massively different insights is the manufacturing assembly line that has been built, according to Garg.

“The difference is other people may have started by saying, ‘I’m going to build a plant that just takes your data and be a data warehouse, or I’m going to be a data lake,’” he said. “We started from the idea that we wanted to have the best machine learning insights.”

“You’ve got be able to connect to a lot of different types of data,” Garg added. “There’s streaming data; there’s enterprise data; there’s contextual data like weather. You’ve got to be able to bring that in and process that and clean it and normalize it in relation to each other. You’ve got to be able to store that data. You’ve got to be able to access that data in real time or at the time that you need to deliver an insight. And unless you start with the idea that what you’re trying to deliver is the insight, you’ll struggle to build the right assembly line.”

Garg pointed out that is the reason Uptake started the way it did.

“It is so complicated, that if you don’t start with the end in mind, you’ll end up building a lot of technical debt,” he said.

Customer collaboration

And by collaborating with its customers, Uptake expects to only get better at what it’s already good at, according to Garg.

“Our overall philosophy is that we are obsessed with outcomes for our customers,” he said. “It’s really through collaborative relationships with customers that we’re all going to get better.”

And through its machine-learning insights, Uptake is seeing a combination of all that, according to Garg.

“We’re seeing that in energy,” he said. “Energy is growing. We are currently doing a deal with one of the largest generators in the world. We just signed a deal with the Department of Defense. So, it’s moving beyond energy, too. We’re in the defense space — a very competitive space. They’re reluctant, often times, to not go with incumbents. So, the fact that they went with us for their Bradley tank is a great affirmation and confirmation of why we’re different.”

Incumbents in energy are also important, and Garg said that Uptake is not trying to make those go away.

“This wasn’t about disrupting; this was about enabling,” he said. “How do we enable these industries to be better at what they do? We’re not out there saying, ‘I can’t wait to destroy Blockbuster or taxi companies or hotels.’ We say incumbents play an important role in the societies and the industries they’re in.”

Successful outcomes

Uptake has made a lot of strides in wind energy and other industries as it provides its insights.

“Our proudest moments are when a customer sees an outcome,” Garg said. “For instance, when we identify an insight that shows a turbine was underperforming by 12 percent, which was going to cost you at least $30,000 on an annual basis. Or we discovered a gearbox failure that, had it gone catastrophic, would have shut down your production for two weeks. Those are the things we celebrate and consider our proudest moments. The process is interesting; the outcome is what we celebrate.”

Uptake is involved in many different industries other than wind, but, by using data and insights discovered elsewhere, Uptake can often get a head start on developing insights for wind energy, according to Garg.

“Say I’m trying to predict the failure on a piece of rotating equipment. It could be a gearbox; it could be a generator. That is a general category,” he said “There’s a lot that I can learn from another industry about how a bearing has performed on an airplane that would be helpful for me to understand as I get into the wind world. Even though it may be a specific type of bearing, I still have a faster starting point based upon what I’ve learned from other industries.”

Another thing that’s really important in the world of insights and predictive machine learning is looking for patterns in historic data, according to Garg.

“It opens up the aperture a little bit in terms of the type of data you can look at in developing your model,” he said. “A great example of that was we were trying to figure out tire failures in airplanes. The fact is: There isn’t a lot of data about tire failures in airplanes. But because we created our predictive insight models based on tire failures in construction and mining equipment, it gave us a running start and got us 70 percent of the way there. And then we can tune the models based on what data is available.”

Where the major benefit comes in for Uptake is, for each of its machine learning engines, those get tuned and more refined through data from all the industries and not just that one specific industry, according to Garg.

“We are able to bring in data from other customers in terms of the insight models and other wind customers,” he said. “And then we’re able to bring other people who have similar equipment in other industries. Data is such an essential piece to refining the precision and accuracy of your model.”

Visionary customers

In some cases, Garg said Uptake is still in the beginning stages of convincing potential customers about the importance of industrial AI.

“I’d say we’re in the first, maybe second inning — if we’re lucky — of this game,” he said. “Everyone agrees that this is transformational technology that is inevitably going to change the very business models that companies have. No one’s quite figured out the perfect business model to do that with. So there’s still a healthy amount of skepticism.”

Uptake is in search of customers who can understand the long-term vision and benefits of digital transformation.

“We’re looking for people who are visionaries, for people who understand that this is going to be an evolutionary process,” Garg said. “That this is a process, not an event. It’s still a sea-sweep sell, because it’s so different from the way people have operated, and the implications are so great on processes, that, if you don’t have the CEO or somebody who owns the profit and loss, who has the vision of how this can drive the business, even if somebody else were to buy it, it’s not a good thing for Uptake.”

Uptake wants people who are open to its message, and Garg said that’s still not the majority.

“Because we base things on outcomes, we’re more than willing to share risk with regard to delivering insights and tying those to outcomes,” he said. “We know we’re early. We know we’re not going to be able to say 100 percent, ‘yes, definitively, there’s a direct line between this insight and this outcome.’”

Part of what Uptake wants its customers to understand is the company is willing to share the risks and the rewards along the journey, according to Garg.

“People don’t doubt our ability,” he said. “One thing that’s changed in three years versus when I first started was people were asking: Can you do what you say you can do? We don’t have that conversation anymore. Now it’s about: How is it going to fit into my business; what are the outcomes, and, if I spend the money, what happens if we do better or do worse, and how do we share in that? It’s become more of a commercial than technical conversation.”

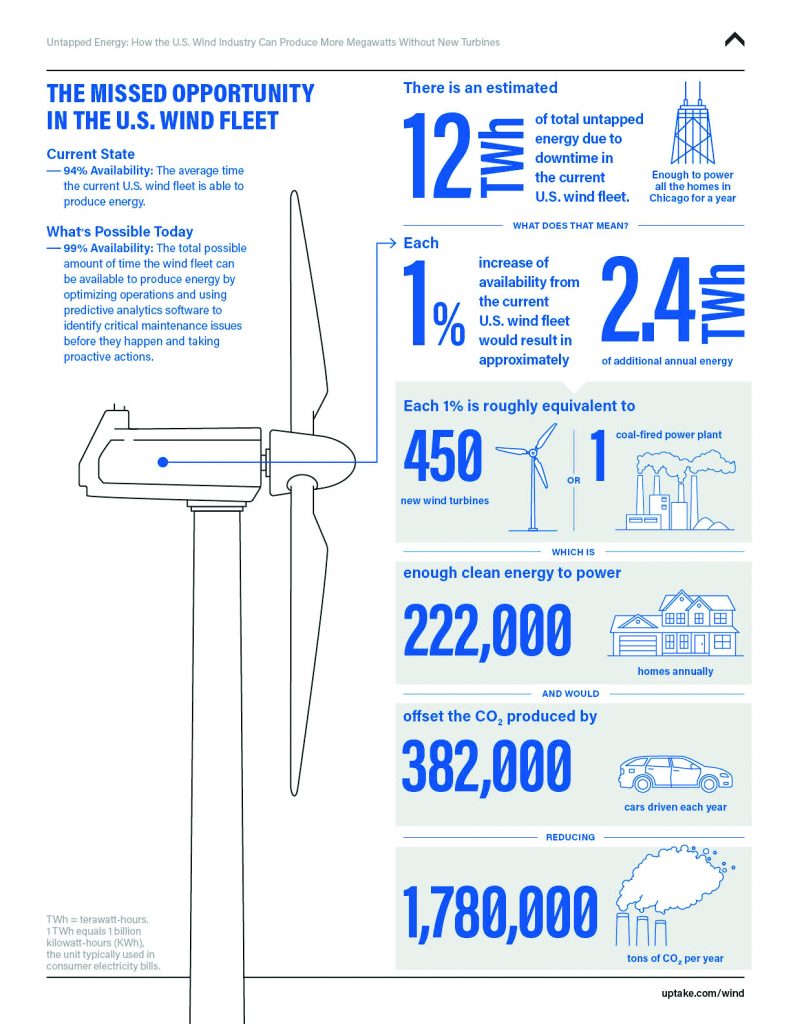

As wind energy grows in the next 10 to 20 years, Garg said he expects the emphasis on construction to decline as O&M increases.

“Where the focus is going to be I think, starting now, but definitely in the next 10 to 20 years is output and the production around that specific turbine and that fleet and those farms,” he said. “That’s where Uptake becomes important, because, wind-farm owners are saying, ‘I’ve already spent this money; I’m expecting to make this money, if I don’t produce my megawatts at the right time and get paid the right amount, then I’m not going to make that money.’ We’re all about how a customer is producing megawatt hours when they need to be so they can make money.”

Garg said an example he cites as inspiration in the energy field happened with nuclear power in the 1990s. Half the fleet was operating at 48 percent capacity, and now it’s about 94 percent.

“And that was all based on better insights to drive the output of a fixed asset, and they got more megawatt hours,” he said. “The same thing is going to happen with wind and is happening with wind. That’s why it’s a sweet spot with us.”