The offshore wind industry is gaining momentum thanks to ambitious environmental targets, competitive costs, and huge market potential. This renewable source of energy provides an optimal load factor, minimizing the need for electricity storage or complementary dispatchable sources of energy. The public sector has been rushing the field with new players, including oil and gas companies, creating a strong push for investments in the wake of the COVID-19 crisis.

Ambitious national targets

Since the 2015 United Nations Climate Change Conference, most governments have launched energy transition strategies and are adopting a variety of approaches to decarbonize. [1] Historically, offshore wind development mostly took place in Europe in the North Sea, and China has set ambitious targets for offshore wind. But so far, the United States has been less ambitious. The European Union (EU) is aiming to install between 230 and 450 GW of capacity by 2050, and China announced 175 GW over the same horizon.

Meanwhile, the United States is aiming for only about 85 GW. Although there is less visibility on China’s road map, offshore wind could help accelerate the end of coal power — improving air quality and ensuring energy security along the way.

Competitive economics

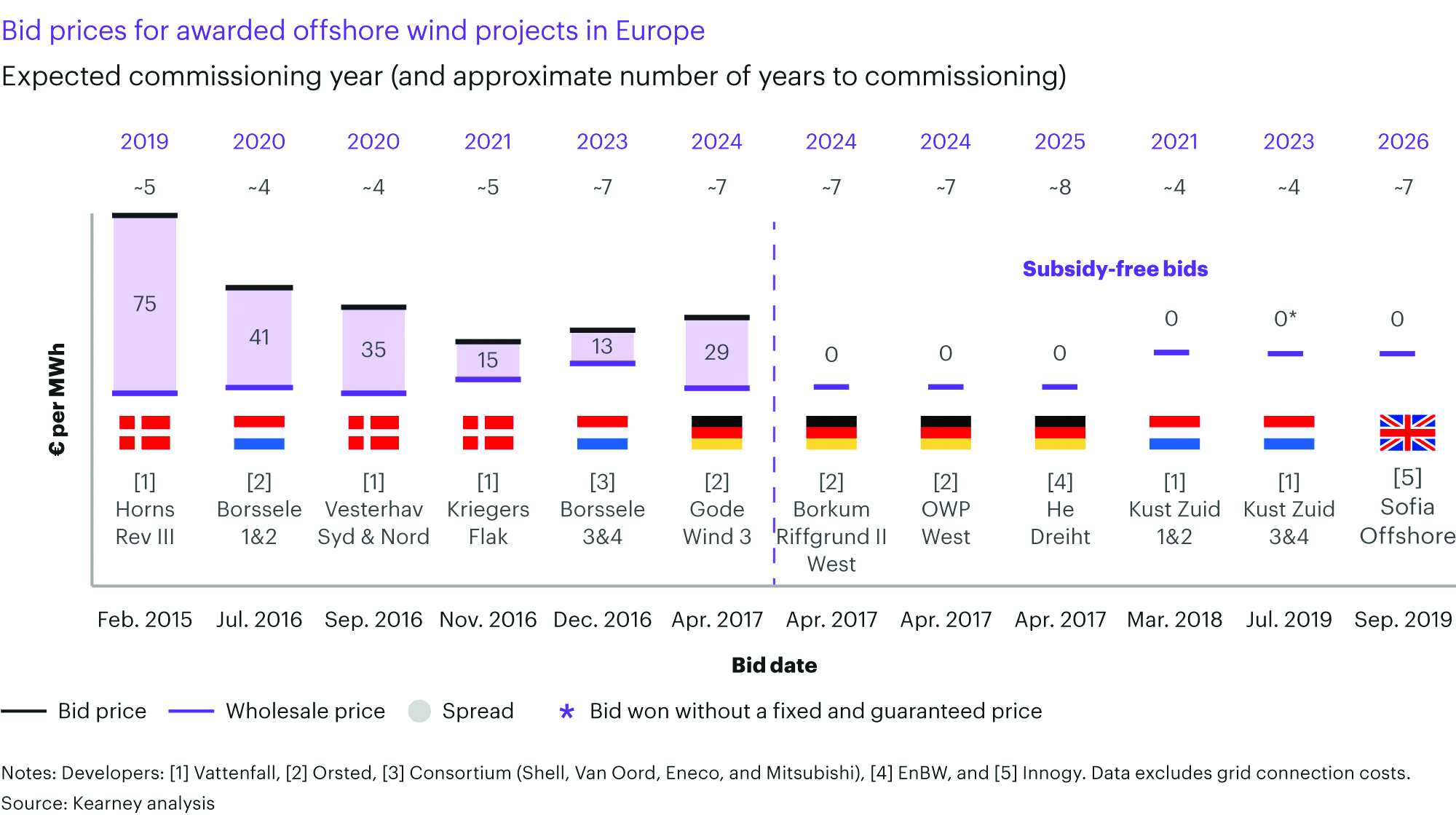

The economics of offshore wind are improving as the costs come down, and the energy source becomes more competitive with not only fossil fuels but also other renewable technologies, including solar photovoltaics (PV) and onshore wind. [2] As wind turbines grow (up to 12 MW and already announced 15 MW), the load factor could reach new records — greater than 60 percent — making offshore wind technology even more cost-competitive in the future. The International Energy Agency (IEA) predicts a sharp decline of offshore wind’s levelized cost of electricity (LCOE) until 2040, down from about 150 euros per MWh to 25 euros to 45 euros MWh depending on the geographic setting. [3] This has enabled a key change with the emergence of subsidy-free bids (see Figure 1). [4]

Huge energy potential

Despite significant growth over the past several years, mostly in Europe, offshore wind is still a very small share of world power production (68 GWh in 2018, or about 0.3 percent) and installed capacity (28 GW in 2018, or about 0.4 percent). [5] Technical sources offer a power potential of more than 25,000 GW globally, with the United States having the largest offshore wind technical potential both for near-shore and far-from-shore zones (more than 10,000 GW).

Offshore wind capacity is expected to grow by about 25 GW per year over the next two decades, activating a limited share of technical potential. [6] Furthermore, offshore wind is displaying strong resilience amid the COVID-19 pandemic with annual capex expected to equal offshore oil and gas capex both in Europe by 2021 and in the United States over the next decade. [7]

Market dynamics are creating new tensions in the offshore wind industry

Attractive growth prospects are creating complexities and challenges in several areas.

The development of offshore wind is influenced by local market factors, and countries are adopting a variety of approaches to foster renewables growth: [8]

Energy security: This is a key incentive for the EU, but the United States is less concerned despite benefiting from the world’s largest source of offshore wind. The EU has defined a clear ambition with a strong commitment from countries and structured supporting policies, including the Green Deal, potentially boosted by the Next Generation EU recovery plan.

Wind turbine manufacturing capacity: This is well-established in the EU, with leading capacities already deployed in the North Sea. In the United States, offshore wind is still an emerging market, with only 30 MW of installed capacity in the first half of 2020.

In the United States, despite strong fundamentals such as the technical potential and support mechanisms, full development of the offshore wind value chain is far from achieved and will require structured support. In China, offshore wind should benefit from a centralized administration, adequate infrastructures, potentially huge wind-turbine manufacturing capacities, and logistics capabilities. This implies short contracting procedures, government support, and no public acceptance issues.

Power grid flexibility and regulation: These areas could provide additional complexity and embed various integration capacities, such as grid connection technologies, bidding processes and contracts, merit order, and support mechanisms for connection costs. Even if some countries already have reached their integration capacity, the European network is very well integrated, providing additional capacity for offshore wind integration. The U.S. power grid is fragmented and has a limited capacity to deal with a large share of intermittent electricity. China’s power grid is integrated, which would favor the integration of wind power. Finally, large hydro-storage capacities provide the ideal combination with wind offshore.

Larger and more complex scope

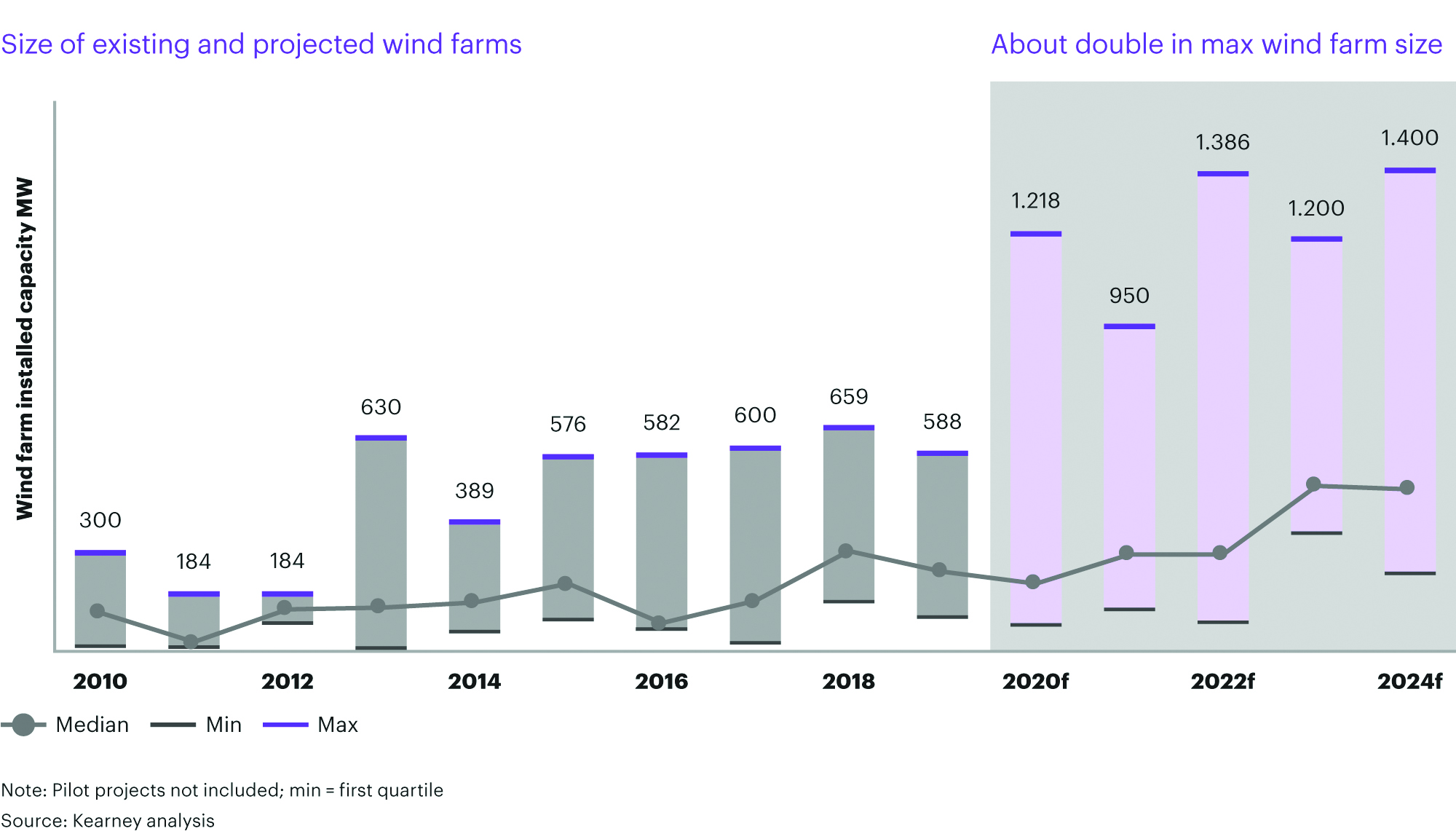

This year marked a step change in the size of wind farms, with the largest wind-farm size doubled compared with past years (see Figure 2). In addition, hybridization with other technologies will be crucial for economic and environmental viability. Recent bids show a combination of offshore wind with green H2 (electrolysis). For example, in July of 2020, Shell and Eneco were awarded a tender to create a wind-farm-powered green hydrogen hub. [9]

On the technology side, floating solutions can unlock additional upsides. They address the largest technical potential of offshore wind (72 percent of offshore wind’s technical potential is in deep water) and higher load factors, driven by better wind conditions. In addition, floating solutions enjoy better acceptability and reduce usage conflicts with other sea activities, such as fishing, coastal navigation, and recreation. However, several challenges are yet to be addressed, including the high upfront cost and long project timeline, the infrastructure needed to assemble turbines, and full-scale testing and demonstration (coping with pitching and rolling, resisting harsher weather conditions, and handling cable complexity). The design of floating solutions is also still at an early stage of development.

Increasing competition and key players’ strategic moves

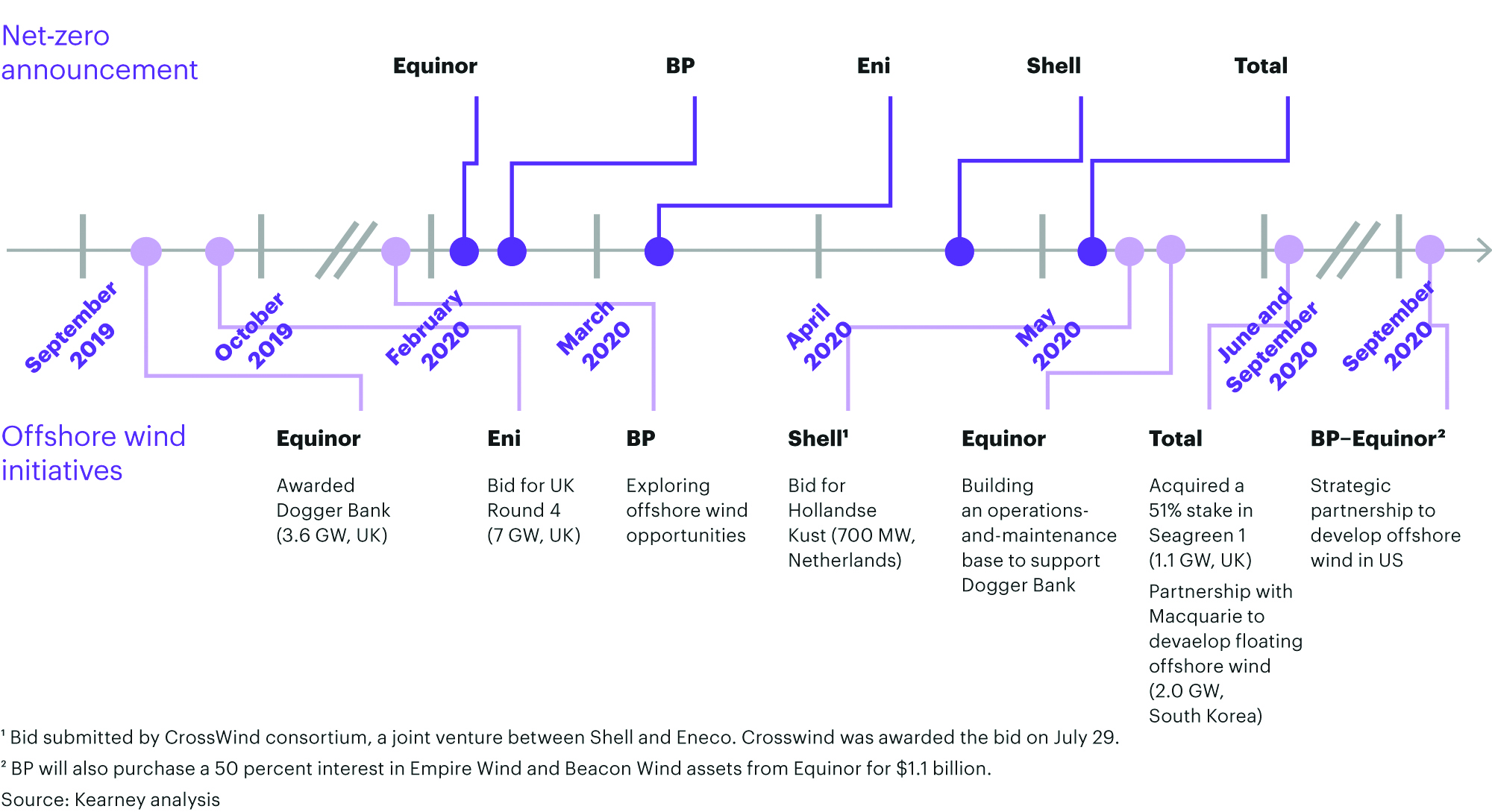

The offshore wind landscape is becoming more crowded with several new entrants along the value chain. While traditional players are pursuing aggressive growth to stay ahead of the game, solid new entrants are reshaping the offshore wind landscape. [10] The net-zero boom hit the oil and gas majors in 2020, with Equinor followed shortly by most peers. To support their net-zero targets, oil and gas operators are walking the talk with several offshore wind initiatives launched over the past year (see Figure 3).

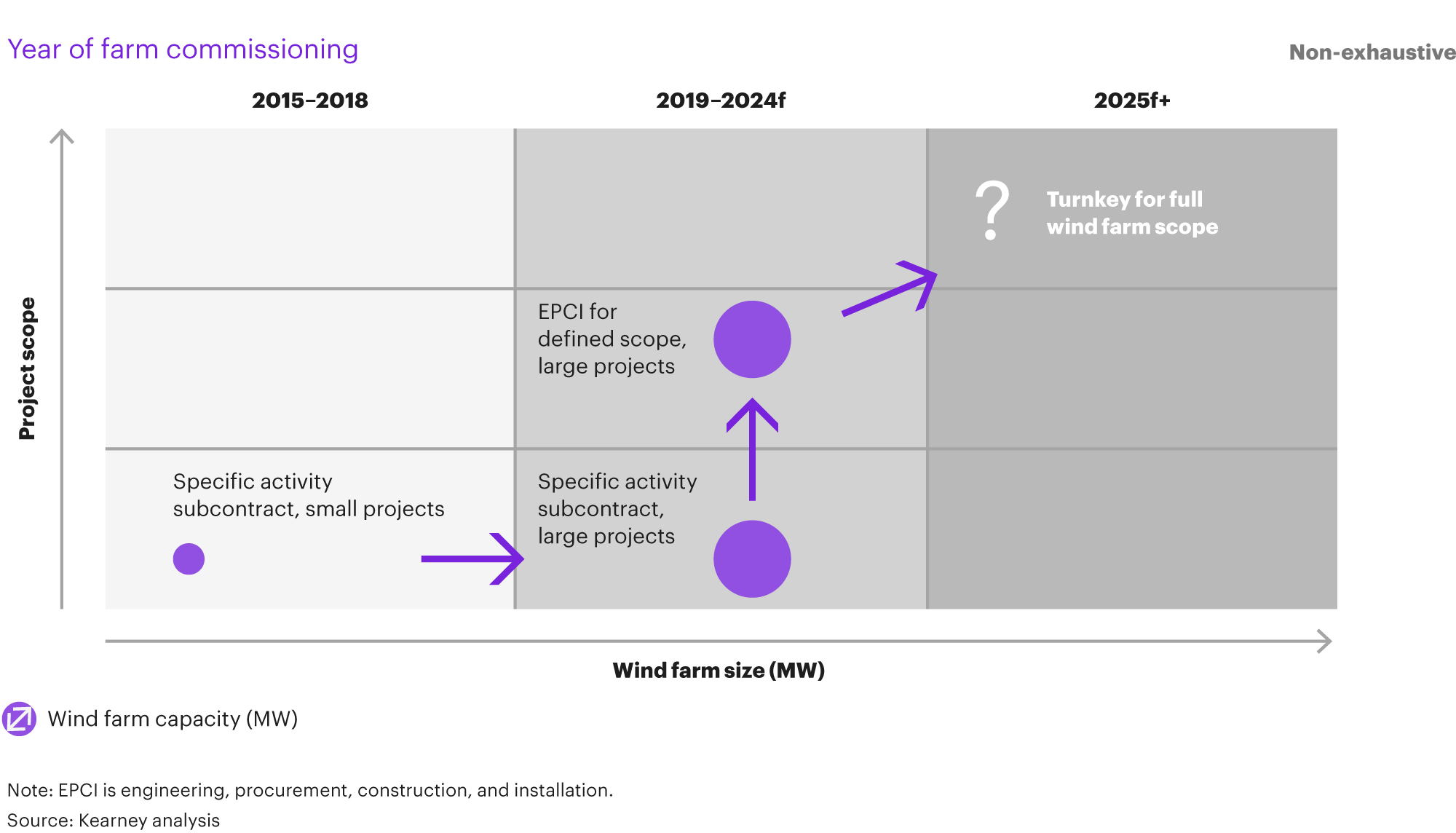

On the project development side, traditional oilfield services and engineering, procurement, and construction (EPC) players are capitalizing on their offshore capabilities and diversifying into offshore wind (see Figure 4). Traditionally, oil and gas EPC had been marginally involved in offshore wind projects as subcontractors for specific activities with limited scope, such as installing foundations for pilots or small wind farms. Now, they are repositioning in the value chain to deliver larger, more complex project scope — from subcontracting for large wind farms to taking on engineering, procurement, construction, and installation (EPCI) roles for a defined project scope. In the future, the role of EPC players may evolve to deliver turnkey projects for a full wind farm, with examples so far only seen in Asia.

Potential supply chain bottlenecks

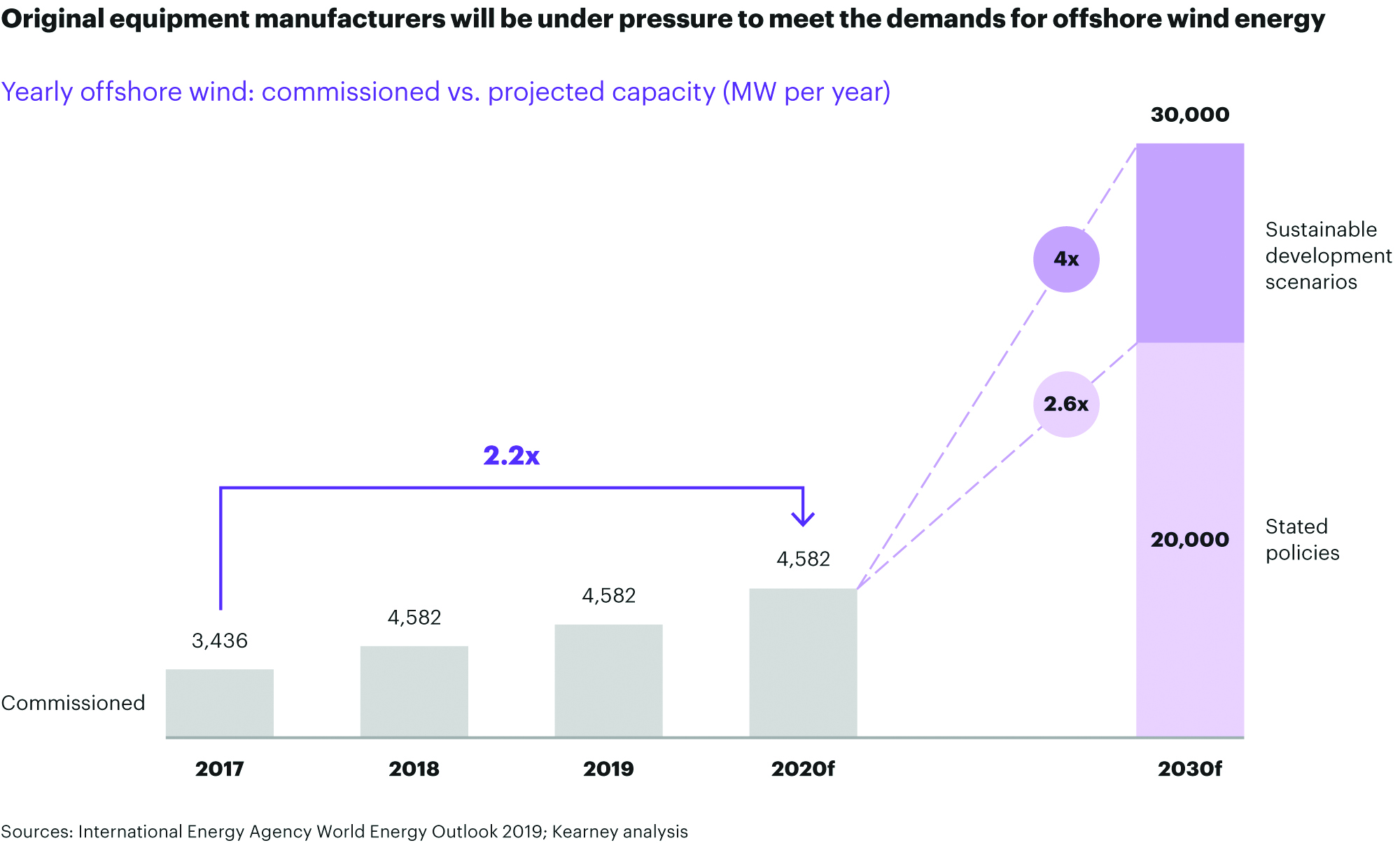

Delivering the potential will most likely stretch the value chain, with bottlenecks for turbine production and logistics. The first question will be about whether original equipment manufacturers (OEMs) have the capacity to expand production to meet demand. Over the past several years, OEMs delivered an annual installed capacity of about 7 MW, but demand will grow to about 20 to 30 MW per year until 2030 (see Figure 5). This gap could be even wider depending on OEMs’ financial situation. In parallel, high demand in marine logistics (offshore vessels) could create scarcity and tension on prices.

How to win the new gold rush

As discussed, offshore wind energy is a strong candidate for massive growth in some regions. However, an array of market dynamics is creating tensions that are affecting the value chain and creating potential bottlenecks that could affect the overall outcome of projects. Winning the new gold rush will require taking a systematic and collaborative approach.

Choose your battles

The first priority is to identify the sites that have the highest strategic value for your objectives, including growth targets, the portfolio, and the footprint. It will also have implications for local factors, such as grid connection technologies, bidding processes and contracts, merit order, support mechanism, and time to operations, as well as for regulations, such as the Urban Planning Code authorization for building turbines of more than 12 MW.

Bidders will need to master the contracting process across countries and regions, including understating the prerequisites and differentiating elements to win the bid. The competition is getting tougher. For example, in the Dunkirk wind-farm award, the top five bidders all scored very closely in the tender criteria, with a slightly bigger difference in the bid price: 44 euros per MWh for the winning and between 47.5 euros and 51 euros per MWh for the others. [11]

Streamline the wind-farm delivery model

Delivering much larger and more complex wind farms requires moving away from the traditional master-servants project development approach with its many siloed interfaces. Collaborative design optimization could significantly reduce costs and fast-track the time to market. Offshore could unlock significant value by taking advantage of lessons learned from other industries, such as automotive, aerospace and defense, and electronics. While the oil and gas industry has traditionally struggled to do so, offshore wind has the features needed to be successful, with strong standardization potential and flexibility for lean design (lacking heavy legacy specifications).

A new delivery approach also requires new business models and new ways of working. Strategic alliances are a win-win for operators, OEMs, and EPC to tackle the following elements:

- Improve the project economics by working together to address large cost areas, taking on the full envelope of costs and seeking to bring it down as opposed to traditional sourcing requests for proposals (RFPs) that are focused on price and likely to increase with change orders.

- Reduce cycle time by accelerating execution and avoiding RFP and tender processes.

Develop technological synergies with contractors by engaging them in advance to elaborate on designing an optimal solution. - In a capacity-constrained environment, strategic alliances also offer opportunities to secure material and services while giving suppliers certainty about revenues. Oil and gas players (operators and EPC) can also capitalize on their strong offshore experience. Repurposing assets and reskilling the workforce require a new cross-business portfolio view and management, such as multipurpose vessels serving oil and gas platforms and wind farms, and talent management, such as sharing resources across oil and gas and wind projects.

Achieve operational excellence

Operators will need to assess and extract the wind farm’s true potential. With more pressure to reduce costs and with subsidy-free bids becoming the new norm, operational excellence is paramount to maximizing profitability. Smart operations are a must to optimize both the top and bottom line by considering a broad set of parameters, such as revenues, cost of spare parts, market dynamics, regulations, turbine downtime, weather forecast, and operations and maintenance costs. Advanced analytics could allow for precisely predicting the impact on costs and revenues to inform decision-making and optimize profitability.

Predictive maintenance enables striking the right balance between corrective and preventive costs, including the costs of failure, reducing total expenditures, and increasing availability and reliability.

Digital twins can extend the life of assets by combining operational and physical inputs, such as inspection information and mechanical characteristics, with advanced simulation, such as fatigue analysis, inspection plan, and predictive maintenance. In addition, using digital twins in the engineering phase could optimize design and reduce material and installation costs.

Squeeze financial value

Finally, operators will need an integrated approach to optimize their financial value.

Value pools: The boundaries between sourcing, trading, and production are blurring, driven by demand response, batteries, and decentralized generation. New value pools are emerging from all parts of the chain. Contractual and physical flexibility to match supply and demand and balance the grid, such as capacity contracts, virtual storage, and options and derivatives, drives portfolio optimization and provides growth opportunities. The operating model needs to adapt to allow an integrated steering of power assets, such as renewable, storage, and combined cycle gas turbines, and consumption, such as internal and external, by location, minimum and maximum load, and steerable load.

Decision-making: With renewable energy growth, the power market is becoming more weather-driven, and demand for flexibility is moving toward the short term. Consequently, the speed and quality of decisions are paramount to ensure smooth alignment between power assets and consumers, such as scheduling and re-dispatching processes with assets and consumers to avoid imbalance costs and capture market opportunities as well as increased frequency balance to manage renewables generation unpredictability. To support quality and efficient decision-making, information system infrastructure and data management are crucial to achieve the following:

- Combine massive amounts of data in real time.

- Develop robust data analytics for optimization (analytical models with accurate signals, confidence estimation, and visualization).

- Define the trade-offs for result accuracy versus computation speed.

- Ensure seamless interactions between independent information systems and functionalities.

- Define the trade-offs between multiple performance models vs. a full integrated model, such as individual turbines, wind farms, and country-level portfolios.

- Facilitate internal and external data exchanges.

- Think big and act fast

The economies of scale for large wind farms (more than 1 GW) is the new norm for cost-competitiveness. All players are moving. To leapfrog the competition and not get left behind, it is imperative to quickly screen and target opportunities. Where to start will depend on players’ maturity. In any case, it is important to accelerate the learning curve. For new entrants, this may mean starting with smaller roles or a smaller scope and quickly transitioning to larger, more complex ones.

Choose your partners, and nurture the collaboration

Winners will play a team game with strategic alliances and collaboration across the value chain. This will ensure delivery capacity, such as turbine production, installation, and footprint as well as best-of-breed skills, such as technology and knowledge, while accelerating innovation. A cultural fit and collaboration framework will be essential to success.

References

- European Commission Climate Action Tracker.

- Intergovernmental Panel on Climate Change 2018 special report, International Energy Agency, International Renewable Energy Agency.

- International Energy Agency World Energy Outlook 2019.

- Aurora Energy Research, offshoreWIND.biz, European Commission electricity market reports, Kearney Energy Transition Institute.

- International Energy Agency World Energy Outlook 2019; “Wind energy,” International Renewable Energy Agency.

- International Renewable Energy Agency, Global Wind Energy Council, International Energy Agency.

- “Covid-19 monthly update: 2020’s oil demand recovery slows down, road fuels upgraded for 2021,” Rystad, 12 June 2020; “US offshore wind power spending has oil in its sights,” Financial Times, 7 July 2020.

- International Energy Agency.

- Shell media release, 29 July 2020.

- Company websites, press review.

- Commission de Regulation de l’Energie, Deliberation N. 2019-124