What does MISTRAS Group do for the wind-energy sector?

What does MISTRAS Group do for the wind-energy sector?

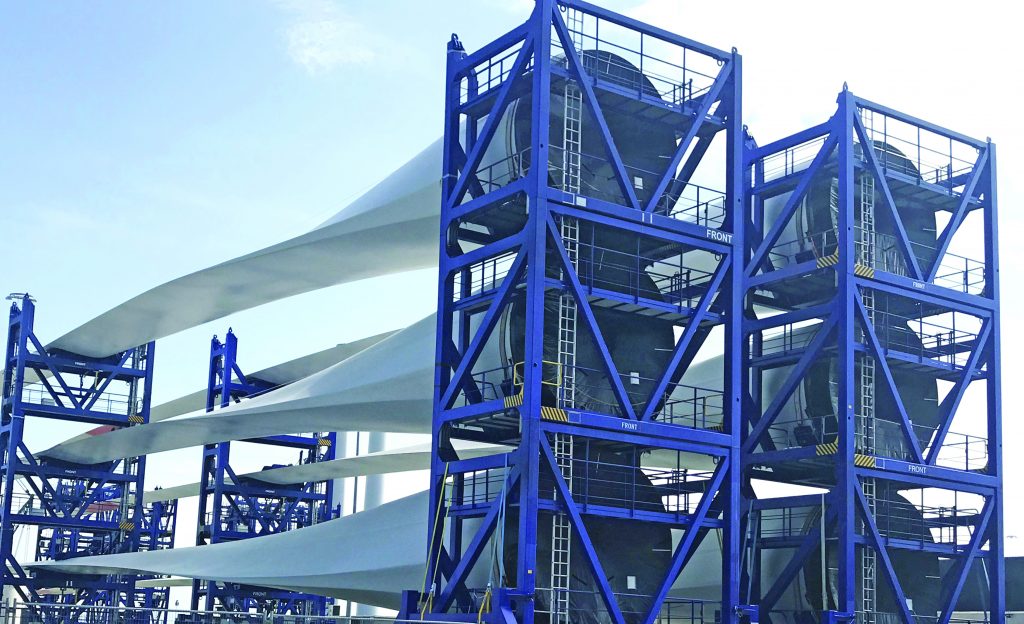

MISTRAS helps to maximize the performance and uptime of renewable wind-energy assets through a unique, integrated approach to wind-turbine protection. This encompasses real-time monitoring, data services, inspections, maintenance and repair, at-height access solutions, and lab testing on newly-fabricated and existing components.

What is Sensoria™, and how can it be an industry game changer?

What is Sensoria™, and how can it be an industry game changer?

Sensoria is a 24/7/365 wind-blade monitor that remotely detects and reports blade damages and makes blade integrity data immediately available for viewing through the Sensoria Insights web data portal. It uses acoustic emission (AE) technology to “listen” for the onset and proliferation of active blade damages, allowing our experts to analyze trends that could indicate active or worsening issues. With the world moving more and more toward renewable-energy solutions, wind-turbine installations continue to grow worldwide. Innovative technologies, such as Sensoria, will help operators maximize the uptime, performance, and safety of their wind-turbine blades as the farm’s assets grow.

Why is it important to be able to check the status of a turbine blade’s condition at any given time?

Unfortunately, the industry norm of conducting inspections roughly once per year leaves site operators unaware of the true condition of their blades and often allows damage to worsen and grow. Damage can occur right after inspection, often getting overlooked and continuing to degrade until the next regularly scheduled review.

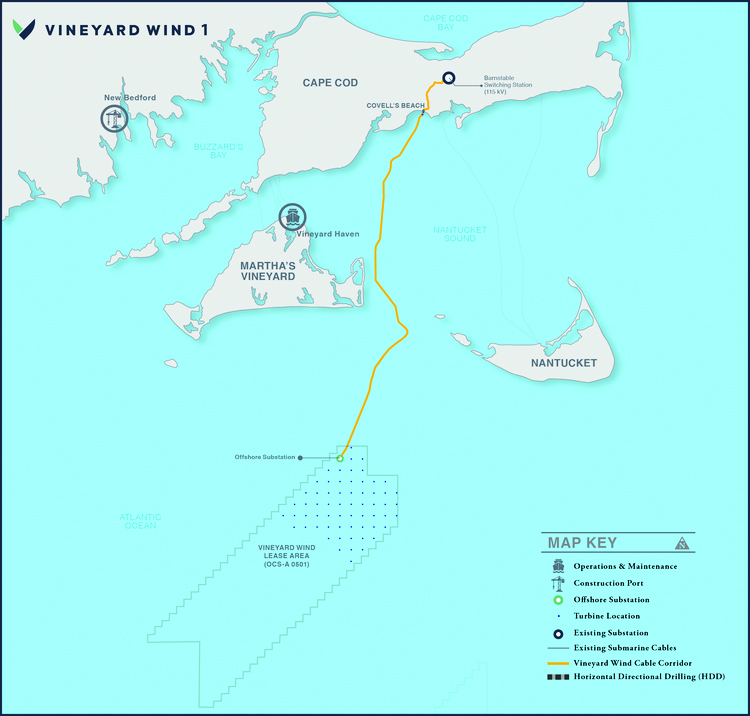

This damage affects onshore and offshore blades (especially larger blades), raising operating and maintenance costs while reducing generating capacity. Offshore turbines are particularly susceptible to inspection and repair delays due to their positioning in areas that are not easily accessible and frequently unpredictable weather conditions, further increasing the need for operators to be able to rapidly identify and mitigate damages.

Because of this, turbine blades require an efficient, real-time monitoring system to identify potential damage before a costly breakdown occurs.

How does Sensoria differ from other methods of blade condition monitoring?

Sensoria, unlike most other blade condition monitors, utilizes proven acoustic emission technology for detecting the presence of defects quickly and reliably. Thanks to sensor and data acquisition technology advances, AE sensors can detect internal and external damage growth on a single blade, making Sensoria easy to install and retrofit, and a sensitive technology for detecting damage evolution.

In addition, Sensoria’s data analysis technology allows us to extract actionable information for the customer. This means the customer can use the information displayed in the Sensoria Insights web portal to direct valuable resources to only the blades that need immediate attention. In the end, this helps the operator optimize inspection and maintenance operations and maximize wind turbine uptime.

Do you see annual blade inspections becoming unnecessary as more wind farms incorporate Sensoria into their assets, or is Sensoria more of a complementary resource to established protocol?

Sensoria enables operators to more effectively guide and plan their inspection and maintenance strategy by providing early warnings of cracking, delamination, high-energy impacts, lightning strikes, and more.

While Sensoria shouldn’t be seen as completely replacing traditional inspection methods, it acts as a valuable complement by offering an efficient, insightful means of identifying damages with optimized use of resources and minimum disruption of production. For example, operators could use drones to complete targeted inspections of only those blades displaying concerning trends based on Sensoria’s monitoring data, completing the job in a fraction of the typical time and with far fewer resources than traditional, full-site inspections require.

What necessitated the development of Sensoria?

Wind-energy producers simply needed a better solution. The driving force behind Sensoria is ensuring that wind-turbine rotor blades function correctly and do not fail prematurely. Nearly half of wind-turbine insurance claims are due to blade failures, so we recognized that current inspection and blade integrity practices simply weren’t as informative, insightful, and timely as wind-turbine operators need them to be. Since MISTRAS installed our first Research and Development (R&D) monitoring system for wind blades in 2012, technological improvements have led to a more cost-efficient and reliable monitoring system. With recent improvements that allow more economical and secure data transfer and communication, plus advancements in sensor technology, Sensoria is fully capable of meeting the technical and commercial requirements of the market.

What has been the industry response to Sensoria?

Most players in the wind industry understand the value of a blade condition monitoring system like Sensoria and know real-time monitoring is a must if they want to reach the current growth projections of 9 percent of world energy output by 2030 and 33 percent by mid-century. Because of that, many are engaging with Sensoria more and more through trial projects with potential large installations at the end of these trials.

Where do you see the future of blade condition monitoring and Sensoria’s effect on that future?

Sensoria’s technology will be especially helpful in improving the reliability of large offshore wind blades (100 million-plus), which typically carry far greater blade inspection and maintenance costs than their onshore counterparts. Further, the large-scale instrumentation of blade condition monitors like Sensoria will only allow the technology to continue evolving and improving. This might allow us to think beyond just blades, possibly integrating nacelles, drive trains, towers, foundations, weather, and operational data into Sensoria’s data, eventually creating digital twins of each wind turbine. With a complete digital view of a wind turbine, operators could run a truly digital wind farm, operating nearly automatically.

What should attendees expect to see when they visit the MISTRAS Group booth at CLEANPOWER 2023?

This event is an opportunity for attendees to discover innovative technologies, such as Sensoria, that will help them maximize their wind-turbine blades’ uptime, performance, and safety. Visitors to booth #1948 will learn more about using a blade monitor to make their blade integrity programs more informed and data-driven than ever. They can also be introduced to MISTRAS’ other wind energy protection solutions including turbine inspection and maintenance services. We can help show them how an integrated approach to blade management reduces downtime, increases efficiency, saves money, and creates a more organic working relationship for sustained wind operations.

More info www.sensoria.com

AES

AES Emerson

Emerson PPG

PPG