A wind farm can contain hundreds of turbines, with each of those turbines housing thousands of individual parts. If not managed properly over its lifecycle, that sprawling wind farm will inevitably become less and less efficient.

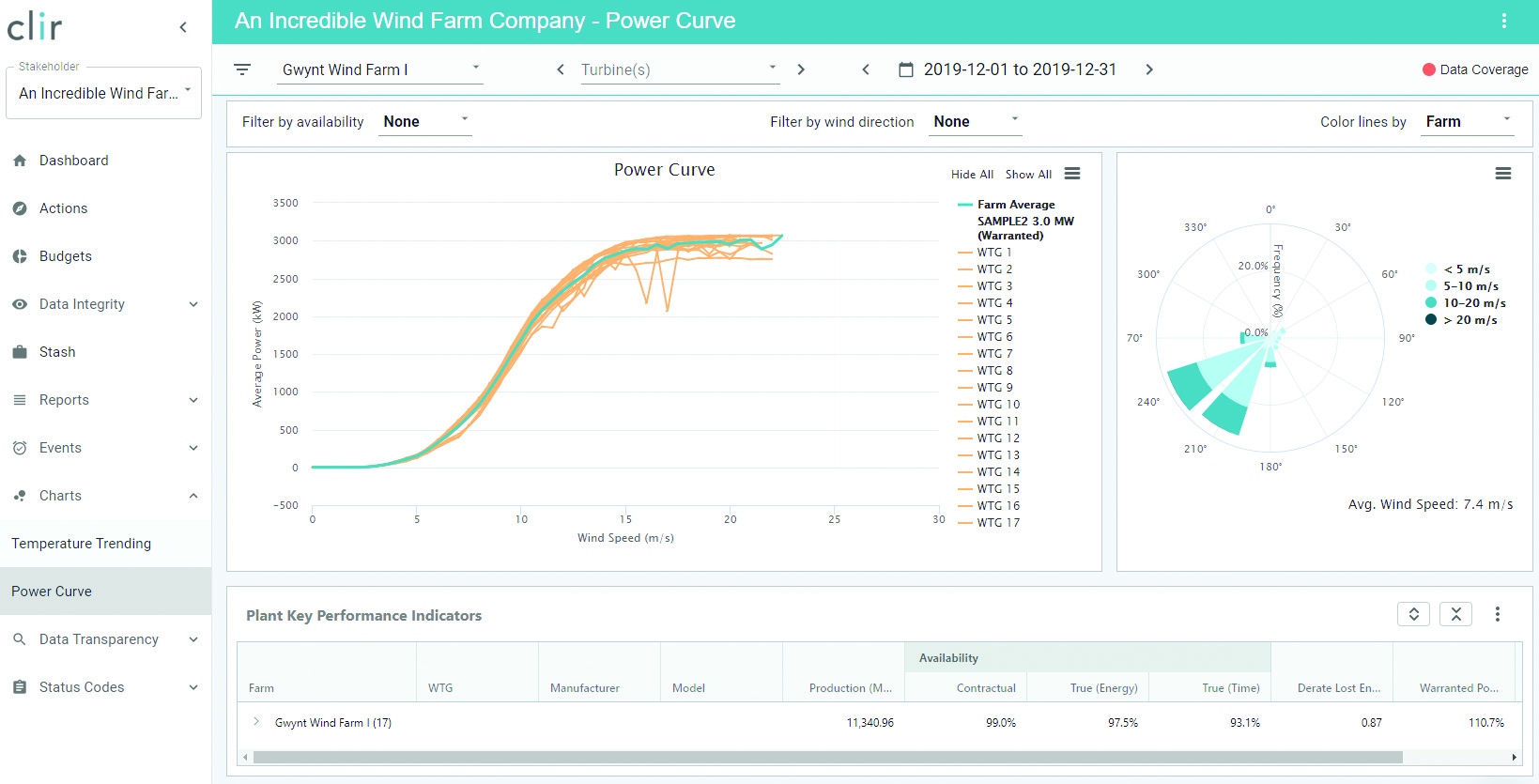

With its cloud-based optimization software, Clir Renewables can show owner-operators how to increase production and minimize costs while revealing how an asset compares to the rest of the industry, according to Gareth Brown, CEO and founder of Clir Renewables.

“We basically connect into the existing signals coming off these plants,” he said. “We’re not putting out new sensors or anything else. We bring that information into our data model running AI and machine learning. Right now, we’ve got just shy of 200 GW of operational data that we are able to use to drive improvements and learn lessons really quickly about our industry, so we can get the most out of these assets.”

Clir obtains that data through partners and clients, and its reach is about a 50-50 split between North America and Europe with some projects in South America, Africa, and Asia, according to Brown.

Four challenges

Driving the management of renewable assets on a daily basis involves what Brown says are four challenges: hard resource, dearth of experience, conflicts of interest in sharing data, and a “race to the bottom.”

“With that first resource challenge, it’s the only power source where you don’t know how it’s going to be delivered,” he said. “In solar, you’ve got acres of solar panels spread out, all capturing the sun’s rays slightly differently. In the wind industry, you’ve got hundreds of meters of swept area, but only a little coffee cup sized anemometer to measure wind speeds — and that anemometer is behind the blades. So, when the asset underperforms by 1 percent, 2 percent, or even 10 percent, it could be really hard to tell because of the limitations in just being able to validate the resource at a turbine level.”

The second challenge is the fact that wind is simply a young industry, says Brown.

“I joined the industry at SgurrEnergy in 2005,” he said. “The reason I got sent to India, China, Sri Lanka, or working out here in the Americas — I would love to say it was because I was so clever and so awesome at my job, but it was a big function of: There wasn’t anyone else. The industry is so big today compared to how it was. Today, we have a dearth of expertise and human capital with a decade-plus of experience, and 10 years ago, our industry was just so small. You’ve got this challenge of a really hard engineering problem of knowing what’s going into the asset. The second challenge is, if you’re any good at your job, you’re probably running a big firm. You’ve probably been promoted to a VP of operations or some other position where the folks working with the assets don’t always have a huge amount of experience.”

The third challenge is often manifested by renewable equipment manufacturers sometimes restricting information about their products, as they try and maintain commercial advantages in the marketplace, according to Brown.

“When they sell you a turbine or a panel, often there’s a lack of transparency around possible performance issues,” he said. “It can make it more challenging to figure out how to improve things.”

The fourth, and most intriguing challenge is how the markets involved with wind are in a race to the bottom, according to Brown.

“It’s amazing how cheap we can produce electricity now from wind and solar farms,” he said. “I would love to say it’s all been innovation and we’ve built these amazing plants, but also, it’s been a blood bath of competition — a race to the bottom where folks really like to win these contracts. Now, developers have to be so aggressive in their financial models on pricing that the industry must cut corners on how much they need for operations and maintenance on their tooling and data and everything else.”

Low-cost, cloud-based computing

Because of these four challenges, Brown founded Clir in order to take advantage of low-cost, cloud-based computing in order to optimize these plants.

“I’ve been doing it for a decade in wind and solar,” he said. “And I give investors, insurers, lenders, and anyone who cares about the technical performance of the asset, the understanding of what’s going on — so we can drive the certainty on performance going forward and so we can get lower cost of debt. We can increase the performance of the asset and drive improvements in our industry.”

But Brown emphasized that Clir’s even greater purpose is to minimize humankind’s impact on climate.

“The way we’re doing that is by taking renewable energy data and turning it into action,” he said. “And we’re not just saying, ‘Hey, let’s fix that gearbox; let’s tweak this aspect of the turbine.’ What we’re trying to do is impact the major cost of wind farms, which ultimately has its root in how expensive the capital you need to develop or acquire a project is. The technical assumptions and understanding of the asset drive the cost of debt that we have on those assets. And if you can get cheaper debt, you can get a higher leveled IRR, if you can get better financial terms.”

Service cost is also an essential element Clir monitors, according to Brown.

“There are things like insurance where our platform has a major impact,” he said. “This has millions of dollars of impact on the bottom line.”

Understanding the assets

And with Clir’s optimization, it gives investors the ability to understand their assets in order to squeeze out as much value as possible, according to Brown.

“We want to make sure that the blades are pitching correctly and the turbines are pointed into the wind,” he said. “We want to make sure that, when you have an icing event in Texas, that the process around that is optimal to make sure the asset is running as well as possible. We want to make sure that if a component — the gearbox, the drive train, whatever it is that might fail — that we’re going to detect that as early as possible, so they can do repairs uptower instead of having a major component failure in the asset forcing a shutdown of the wind turbine for an extended amount of time. That’s our kind of classic monitoring.”

Providing better certainty

The biggest constraint on how big the mortgage on an asset might be is how much confidence an investor has in the asset to produce electricity in the future, according to Brown.

“Because of the variability of the resource in wind and solar, you typically see that leverage on these industrial assets is reduced because you don’t know how much energy is going to be produced in the future,” he said. “With our AI platform, we’re able to provide greater certainty on that. You’re able to secure better debt financing terms from your banks, from your lenders, or from your tax equity.” All those factors and more are involved when a customer approaches Clir with a challenge, according to Brown.

“What we’re trying to do when a customer comes to us is not solely look to provide a software solution,” he said. “Yes, our technology can provide some swift and valuable returns, but really, to come back to the point around limited experience in the industry, we’re also trying to make sure we can help our clients with their biggest challenges.

Essentially, we’re saying, ‘You have these two problems here. We could solve that. But are you aware that your operational data is affecting your insurance rate? The third most expensive item on your line items is your insurance. Are you using that operational data to drive down costs? When you look at your debt financing, is your operational data affecting the terms that you are getting? But also, let’s fix this blade issue that you have here or this performance issue there.’ We’re making it clear to folks that we can’t be asking the same questions that we were asking five years ago because the technology and the demands in our industry — the feedback loops that we have to get in place quickly for us to be as effective as possible to fight climate change — are massive.”

Industry-level strategy

In order to do that, Clir is positioned to offer a data strategy that can be used, not just on the site level, but at an industry level, in order to learn and improve, according to Brown.

“We aren’t installing the same wind technology year on year; it’s bigger and greater; it’s a lot lighter; it’s got different performance issues,” he said. With 200 GW of performance data already under its belt, Brown said that Clir’s goal is to be affecting a terawatt of assets in the next 10 years.

“We’ve got a long way to go, but we didn’t build Clir to be a small, profitable firm in Vancouver,” he said. “We want to be global, and we want to be on all the wind and solar assets around the world.” And with the growth of wind and other renewables booming, Brown expects that to be a realistic goal.

“The industry is just going to go ballistic,” he said. “The fact that it’s already the cheapest form of electrons on the planet anyway, I mean, we’re almost giving away the power at this point. It’s so cheap. I do think that there’ll be a hard lining on that to a certain degree, but the political wins of deploying these assets, all the forecasts are showing just tremendous build-out.”

More info clir.eco