Traditional approaches to due diligence, alongside fragmented knowledge management, are slowing down the flow of new capital into renewable energy projects worldwide, leading to missed opportunities for advisers delivering valuable expertise to their clients, according to LiveDiligence, a software platform that delivers insights to renewables investors and lenders.

The firm is calling for the renewable energy market to “reboot” its due diligence processes to ensure projects are financed and built at the rate needed to meet global growth targets.

“Historically we haven’t seen a lot of cross pollination of ideas between due diligence advisers and the tech world, leading to a lack of innovation in the sector,” said Joss Boxford, Chief Operating Officer, LiveDiligence. “Advisers haven’t been offered compelling alternatives to the status quo, despite widely recognized deficiencies in the current tools and processes.”

LiveDiligence has pinpointed four areas of focus for renewable energy due diligence advisors over the next five years:

- Knowledge management: Those companies with institutional knowledge will consistently deliver higher value with fewer resources, and scale faster through efficient knowledge sharing and accelerated upskilling of new employees. Delivering insights derived from specialist knowledge at speed and scale is vital to expedite clean-energy investment.

- Client centricity: With more complex deals and shorter transaction time frames, traditional static deliverables, often delivered late in the day, will no longer cut it. Deal teams are demanding faster and earlier insights to critical issues and effective interactive collaboration with their full advisory team.

- Emerging regulatory requirements: New requirements for climate risk assessment and other forms of ESG assessment will be increasingly high on the agenda of capital providers, bringing further complexity to the due diligence process. Advisers have an opportunity to start on the front foot by adopting digital tools that can adapt to changing requirements, while simplifying the reporting process for clients.

- Technological and market complexity: Investor scrutiny on emerging technologies such as storage, floating wind, and green hydrogen, coupled with new financing and offtake structures, are driving a focus on technical and financial risk management. The ability to support decision making will be a competitive advantage to advisers supporting the deployment of complex new projects.

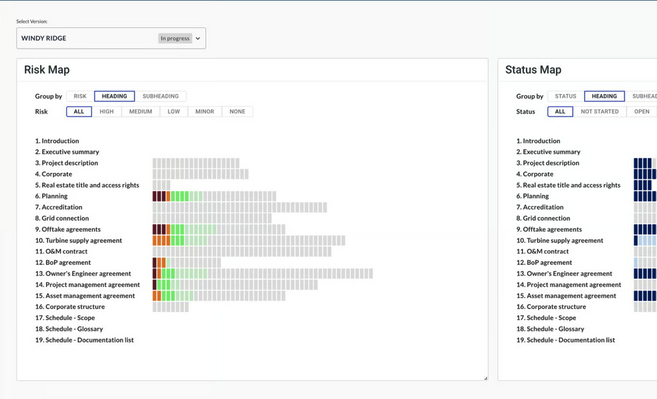

LiveDiligence has been designed to simplify the process of removing investment risk to speed up project financing and deployment, while preserving the specialist knowledge that experienced advisers bring.

The platform creates a collaborative, single source of truth for technical, legal, insurance, and financial due diligence providers – streamlining traditional due diligence processes.

To date, the platform has been used to support more than 400 renewable energy transactions, by more than 700 professionals across 170 different organizations.

More info www.livediligence.com