In 2021, several key pledges were made to revolutionize the United States’ offshore wind-energy sector in the first weeks of the Biden administration, including new targets to generate 30 GW of offshore wind energy by 2030 (“30 by 2030”) and 110 GW by 2050 to catch up with expansive offshore wind development projects in Europe and Asia.

More than $12 billion of funding per year was promised to support offshore wind projects, potentially creating tens of thousands of jobs and powering 10 million homes each year. However, while the finances and the general will are in place, regulations governing workers for such projects have left people in the industry scratching their heads.

To generate more American jobs and reduce the sector’s dependence on foreign labor, the National Defense Authorization Act (NDAA) was amended in 2022 to mandate that those operating and manning offshore vessels and platforms in U.S. waters should be U.S. nationals. The bill also called for an expansion of the Jones Act to deny foreign-flagged offshore vessels from operating in U.S. waters.

While the regulation looks to level the playing field between U.S. and foreign vessels and crews, it could also stymie the country’s wider offshore wind ambitions.

Heather Zichal, former chief executive officer of the American Clean Power Association, called the move “a gut punch to offshore wind projects” that would halt or delay domestic offshore wind-farm installations and affect thousands of U.S. jobs. Crucially, it came at a time where access to a skilled and large-enough workforce is one of the main hurdles for the sector globally.

Preparation is Key

The Global Wind Organisation and Global Wind Energy Council anticipate that 568,800 technicians will be needed to build and maintain a global onshore and offshore wind fleet by 2026 — up 33 percent from 426,700 in 2021. In the U.S. alone, up to 58,000 full-time workers will be needed to support the offshore wind-energy industry between now and 2030.

Building a large, competent workforce takes time. Many in the oil and gas sector are starting to reskill and transition into renewables. To date, the industry has addressed the skills and knowledge gap by relying on foreign crews and vessels that already have the infrastructure and know-how to get wind turbines up and running — something the amended NDAA would stymie.

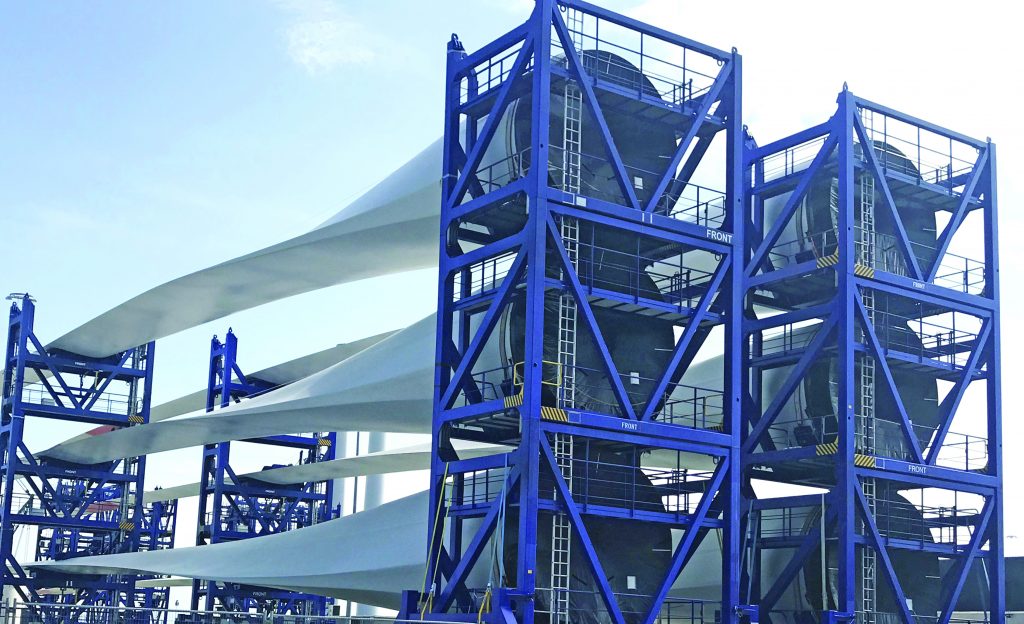

An offshore wind farm can take up to 11 years to build from development, pre-construction to construction, or just seven years with the right equipment and skilled workforce. To meet its “30 for 2030” vision, the U.S. must make provisions, including legislative frameworks, to support offshore wind development.

Offshore wind projects can take several years to materialize from conception to full operation. Across the numerous offshore wind-farm projects GAC has worked on around the world, a common theme stands out: Preparation is key. Offshore wind-farm developers must have the right suppliers, partners, and crew in place to support the construction of their projects.

Shortages of skilled labor and equipment have exacerbated global supply chain challenges, with a knock-on impact on the number and scope of offshore wind-energy projects. GAC offers a range of integrated shipping, logistics, and marine services to provide stability amid the uncertainty the sector faces, including agency and husbandry services, supply chain, barge and tug support, and emergency response capabilities.

Its global footprint and more than six decades of experience in offshore support services have given the group a deep understanding of the challenges its customers face in accessing skilled crew.

GAC’s role as a ship agent and its involvement with crew change operations globally has made it an eyewitness to the struggle to accessing skilled labor in recent years, especially during the COVID-19 pandemic.

Port authorities and governments introduced special requirements for crew-change operations, which reduced the frequency and number of offshore crew changes that we could carry out for almost two years. Now most those restrictions have been lifted, crew change operations have become easier, as have the smaller but equally important aspects of the crew change process such as visas, seaman’s books, and airport and hotel bookings and transfers.

As the U.S. looks to reduce dependence on foreign crews, uncertainties remain over how to build the necessary offshore infrastructure at the pace needed without them, or at least until there are enough U.S. workers trained in this sector.

Turning to Technology

Increasingly, major stakeholders in offshore wind projects are turning to emerging technologies to mitigate labor shortages, reduce overheads, minimize environmental impact, and improve operational safety.

Unmanned survey vessels (USVs) are staking their claim as a core component in offshore renewable energy projects, enabling operations and maintenance players to collect a vast amount of on-site data to aid faster and smarter decision making. Information gathered related to weather patterns, water currents, seabed conditions, and more are valuable when planning other offshore wind-farm projects. And they can reduce the number of on-site specialists required during technical operations.

USV technology could set a new precedent for supporting offshore projects. Unlike a traditional platform at sea, which requires regular crew changes, USVs can reduce the on-site work force and manpower costs, while minimizing the need for technical experts and diving teams to operate in high-risk situations.

However, regulations governing such technology could throw obstacles up so long as legislation surrounding the use of USVs in offshore operations remains embryonic. But with USVs already operating and developing at pace in the offshore sector, it is likely the technology will define the legislation, rather than the other way around.

Advancing technologies could plug the gap as the U.S. looks to shore up its domestic capabilities. And even with a competent local workforce in place, USVs could still play a critical part in the construction, operation, and management of offshore wind farms.

Leveraging Experience

Some of the world’s largest offshore wind-farm developments have been multinational and multicultural projects that involve dozens of companies, suppliers, and logistics partners from all over the world.

Asia and Europe are both prominent players in the offshore wind industry looking to harness the power of greener energy amid surging regional demand. To meet its ambitious wind-energy goals, the U.S. should look to leverage the experience gained elsewhere, particularly when it comes to technology, innovation, and regulation.

These two regions have invested heavily into technology to improve the efficiency and safety of the various offshore operations for wind-farm projects. This investment has resulted in the development of state-of-the-art vessels, equipment, and technology, such as USVs, that have greatly improved the sector’s capabilities.

The U.S. is currently looking to build Jones Act-compliant vessels to support the installation of offshore wind turbines that continue to grow in size. And it can apply lessons learned from Asia and Europe in deciding what best to invest in and develop regulatory frameworks to support its offshore goals, particularly in crew safety.

A robust regulatory framework has been shown to ensure safe and responsible offshore operational conditions, which boosts confidence in the industry, attracts further investment, and enhances the sector’s growth.

By leveraging these lessons, the U.S. can develop a thriving offshore wind segment that contributes to the country’s economic growth and development, while significantly reducing carbon emissions.

Short-Term Concern

The U.S.’s current lack of skilled crew to support its offshore wind energy ambitions is a significant cause for concern — one that will grow as changes to the NDAA take hold. At its core, the U.S. must look to build a domestic workforce that is skilled, trained, and in place to reap the benefits of renewable offshore energy.

While the U.S. Department of Energy estimates more than 43,000 new jobs will be created in the offshore wind market by 2030, with wind-turbine technicians looking to be the fastest growing job in the U.S. market in the coming years, the specialized nature of the offshore sector means a significant investment must be made in local capabilities sooner rather than later. In the meantime, the sector can look to advancements in technology and investments made in offshore wind energy around the world to keep the U.S.’s “30 by 2030” vision alive, at least until domestic capabilities for crewing have caught up.