Long-awaited policy certainty provides a critical shot-in-the arm for the wind industry, leading to a growing pipeline and reinvigorated domestic supply chain.

Last year will go down as a transition year for the wind industry. Build volumes slowed considerably from record levels set in 2020 and 2021. Project delays plagued developers as supply chain challenges, escalating costs, and interconnection delays slowed timelines. And project economics were stressed from elevated commodity prices and general inflationary pressures. But — and it is a big but — the year was punctuated emphatically with the enactment of the Inflation Reduction Act (IRA).

This once-in-a-generation legislation brings 10-plus years of policy certainty to an industry that has been battered by shifts in the political winds. On its heels, expectations for wind development this decade has increased at least 25 percent, and manufacturers are actively expanding or adding to their domestic manufacturing capabilities. Fold in growing demand for renewable energy, and the stars are aligning for a decade-plus of growth.

Before we get to the outlook, let’s examine how the year unfolded for the wind market:

- The U.S. wind market installed 2,696 wind turbines with a total capacity of 8,511 MW, down from 13,400 MW installed in 2021. Although the land-based wind market finished 2022 with its strongest quarter, the annual decline in wind-capacity installation was primarily due to sluggish growth in the middle of the year.

- The 8,511 MW installed in 2022 brings the U.S. to 144,132 MW of cumulative operating capacity. Many of these wind projects are concentrated in the central plains of the U.S., one of the best regions anywhere for locating wind turbines. Texas vastly exceeds all other states’ operating wind capacity with 40,151 MW operating. The next closest state for total operating capacity is Iowa with 12,783 MW, less than half of Texas. A total of 23 states now belong to the gigawatt-club, with seven states containing more than 5 GW of operating wind power. There is commercial wind operating in 41 U.S. states and Puerto Rico.

- The offshore wind market saw signs of progress. Twelve new lease areas across the NY Bight, Carolina Long Bay, and California were auctioned during the year while state targets for offshore wind soared to 81 GW. In total, there are now 51 GW of offshore wind projects in the pipeline, including 17.5 GW of projects that have power purchase agreements in place.

IRA brings much needed boost to the industry

The Inflation Reduction Act represents the single largest investment in renewable power in the history of the country and the largest investment in climate action to date. After years of policy uncertainty — on-again, off-again tax credits, phase down regimes, and pandemic-era policy band aids — the wind industry finally has the long-term policy certainty it has been pursuing for nearly two decades. The policy not only focuses on incentivizing renewable projects, it seeks to drive investment in domestic clean-power manufacturing.

It’s clear this policy is working. In the last eight months, more than $150 billion in domestic utility-scale clean-energy investments has been announced, including 46 new or expanded manufacturing facilities. While much of the focus has been on solar manufacturing, the wind industry is making moves, too. At least 10 wind-power manufacturing facilities have been announced, including eight focused on the land-based market and two geared toward offshore wind.

A transition year for land-based wind

Last year saw a significant decrease in wind capacity installations compared to both 2020 and 2021. Rising commodity prices, increased supply chain costs, the phase-down of the PTC, and the on-going effort to rebuild development pipelines following record activity at the start of the decade, all contributed. Developers commissioned nearly 4.9 GW less wind power in 2022 compared to 2021, which itself was a down year compared to a record 2020. Year-over-year, wind installations declined by nearly 37 percent in 2022.

Wind developers delivered 40 project phases online, including repowers, totaling 8.5GW in 2022. These projects were spread across 14 states, including nine states that added 500 MW or more. Texas and Oklahoma once again led all states in new wind power, installing 4.2 GW and 1.4 GW respectively. The largest project built in 2022 is the 1,029 MW Great Prairie Wind project spread over both Oklahoma and Texas. The Traverse Wind project was close behind at 996 MW.

Despite a down year, the market shows early signs of improving. Developers are currently pursuing 20.8 GW of projects that are either under construction or in advanced development.

BOEM active on the auction block

The Bureau of Ocean Energy Management (BOEM) had a busy year as the agency auctioned off 12 offshore wind project leases. The action is part of BOEM’s Offshore Wind Leasing Path Forward 2021-2025, which details the agency’s goal to hold lease auctions in seven regions across the United States. These auctions are critical as the industry seeks to deliver 30 GW of offshore wind power by 2030.

In February 2022, six lease areas in the New York Bight were awarded in the BOEM’s largest single offshore wind lease auction to date. The auction raised $4.4 billion in revenue, and leases went for between $6,147/acre to $9,933/acre. This record-breaking offshore wind lease auction highlights the strong opportunities for developers in the region. New York and New Jersey both have ambitious offshore wind goals and detailed procurement schedules.

In May, BOEM auctioned two leases, this time in Carolina Long Bay. Combined, the lease areas total 110,091 acres and fetched $315 million in the auction. BOEM concluded the year with the much-anticipated auctioning of five lease areas off the California coast. These first lease areas on the West Coast include two near Humboldt Bay in Northern California and three near Morro Bay in Central California. Bidders paid a combined $757 million for 373,268 acres.

BOEM plans to hold lease auctions in the Gulf of Mexico (2023), Central Atlantic (2023), Oregon (2023), and the Gulf of Maine (2024) to complete its Path Forward plans.

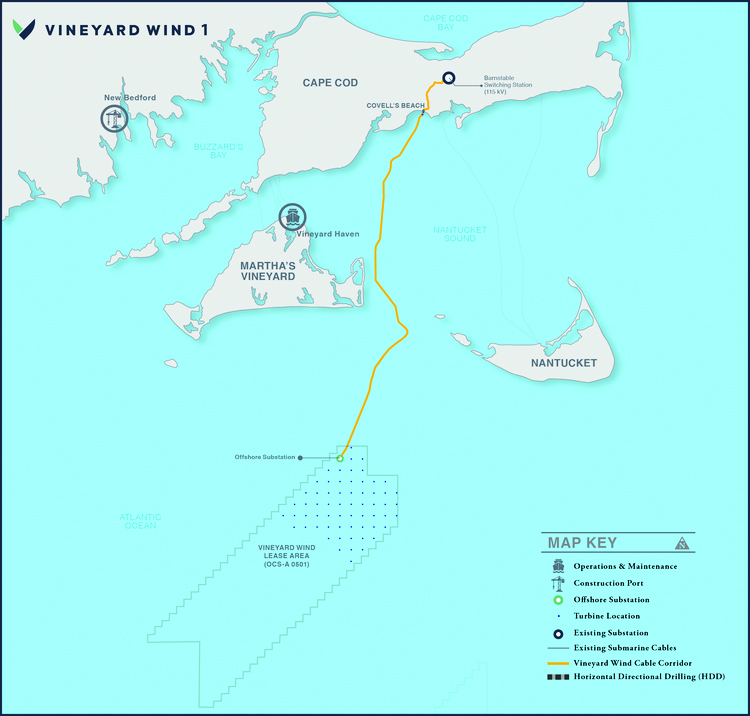

A major milestone was achieved in November 2022 as the first commercial-scale offshore wind project, Avangrid and Copenhagen Infrastructure Partners’ 806 MW Vineyard Wind project started offshore construction. The project is expected to be operational this year.

Offshore construction has also commenced at South Fork Wind, a 132 MW Ørsted and Eversource project. After receiving a ROD in November2021, started onshore construction in 2022 and moved to offshore construction in March 2023.

There are two offshore wind projects online in the United States — Ørsted’s 30 MW Block Island Wind Farm off Rhode Island and Dominion Energy’s 12 MW Coastal Virginia Offshore Wind Pilot off Virginia, the latter of which came online in early 2021. There are 18 projects in development that have secured offtake, totaling nearly 17.5 GW, and a further 33.8 GW of projects are in early development.

State offshore wind targets ballooned to 81,000 MW

States continue to be the main drivers of offshore wind development in the United States. Kicking off the year, Louisiana announced an offshore wind goal of 5 GW installed by 2035 as part of the state’s first ever Climate Action Plan. California added to the mix by establishing a short-term goal of 2 to 5 GW by 2030 and a long-term goal of 25 GW by 2045. Maryland is the latest state to join the crowd after lawmakers passed a bill in April 2023 establishing an 8.5 GW by 2031 offshore wind target. In total, 10 states have combined to set offshore wind procurement targets of more than 81,000 MW.

A major improvement in the wind outlook

As a result of the passage of the IRA, market consultants significantly revised their land-based wind outlook for the rest of the decade. In fact, forecasts improved 25 percent on average. The additional 20 GW this decade brings total expectations for 2023-2030 to 102 GW. Forecasts range from a low of 87 GW to a high of 120 GW.

Development volumes will grow each year through the end of the decade and will eventually reach nearly 16 GW on average in 2030, with one consultant predicting 19 GW in that year. But the road ahead is not without obstacles. High interconnection costs, long transmission study wait times, congestion in wind-rich regions, and difficult permitting regimes all stand to slow wind-power development. New transmission lines coming online in the middle of the decade will help, but slow progress overall in long-haul transmission expansion puts an upper limit on the market.

In the offshore market, the outlook has also improved. It’s still not to the level of the industry’s nor the Biden administration’s expectations, but consultant forecasts are heading in the right direction. Bloomberg, S&P Global, and Wood Mackenzie anticipate, on average, 26 GW of offshore wind to be operating in 2030, a 2-GW improvement over last year’s forecast.

The most optimistic forecast projects offshore installations to hit 28 GW by the end of the decade, within reach of the 30-GW goal.

The offshore wind market is largely driven by state policy support, solicitation schedules, and seabed leasing availability. Chief among forecasters’ concerns are long development timelines, anticipated delays, supply chain bottlenecks, and other factors. Multi-gigawatt annual installations are expected starting in 2025, while 2030 is anticipated to be the peak year for new offshore wind additions at nearly 5 GW.

All-in-all, there are many reasons to be optimistic about the future of offshore wind. After many years of promise, this industry is now poised to deliver.