Global wind-turbine order intake increased 11 percent YoY, overtaking the previous record set in Q4 2018 by 13.2 GW, according to new research from Wood Mackenzie.

As noted in the Wood Mackenzie report, “Global Wind Turbine Order Analysis: Q3 2019,” developers globally ordered a record 31 GW of wind-turbine capacity in Q2 2019. Demand in China and the U.S. contributed to a total of 79 GW ordered over the last four quarters, despite a decrease of 41 percent YoY in Europe during Q2. China and the U.S. enjoyed top quarters for capacity ordered as developers rushed to procure turbines with sufficient time to commission projects before 2020 subsidy deadlines in both countries.

“Developers in China ordered more than 17 GW in Q2 2019, a 267 percent uptick YoY compared to Q2 2018; 71 percent of firm-order capacity was secured in the Northern region’s onshore wind market in Q2 2019,” said Luke Lewandowski, Wood Mackenzie director of Americas Power & Renewables Research. “The order volume for five major developers in China exceeded 1 GW last quarter. The record quarter in China included more than 3 GW of offshore capacity, nearly 2 GW more than in Q2 2018 and a 800 MW increase on the previous quarterly record in the country (Q1 2019). This added to a backlog of nearly 12.5 GW.”

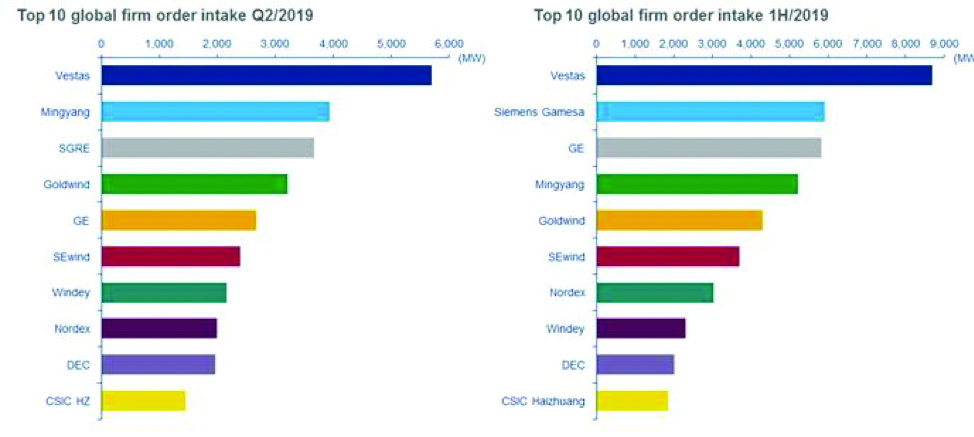

Vestas won the largest share of order capacity for the fifth straight quarter, enjoying the best quarter for an OEM in any year.

“Despite a massive quarter for orders in China, diversity in the market — illustrated by seven OEMs with more than 1GW of order capacity — prevented a dominant leader, which allowed Vestas to retain the top spot,” Lewandowski said. “Eight of the top 10 onshore models in Q2 are manufactured by Chinese OEMs, six of which made the top 10 for the first time ever. All six were new models that had never been ordered publicly prior to Q2. Vestas was the only non-Chinese OEM with any models in the top 10.”

Order intake in the 4.0-4.99-MW segment increased for the fifth consecutive quarter, exploding to more than 9 GW of orders.

“China, the U.S., and Brazil continued to lead the way in this ratings segment, with 91 percent of capacity orders coming from those three countries,” Lewandowski said. “Vestas, SEwind, Mingyang, Goldwind, and DEC compiled orders for more than 1 GW in this ratings segment.”

Turbine pricing increased in several markets due to strong demand and larger, newer, more expensive models hitting the market.

“Pricing in the U.S. and China increased due to strong demand, as order books continue to fill up in preparation for 2020 installations,” Lewandowski said. “Turbine prices in India have remained unchanged QoQ as developers push back against aggressive auction price ceilings set by the government, however the U.S. dollar has gained 4 percent in value against the Indian rupee since July 2019. This makes Indian turbine prices lower in USD. Newer models in the market and demand for larger turbines in Brazil caused pricing quotes to rise.”

More Info woodmac.com