Green hydrogen production can compete with fossil fuel-based hydrogen by 2030 in Australia, Germany, and Japan, should renewable power prices reach $30 per megawatt hour (MWh), new research from global natural resources consultancy Wood Mackenzie indicates.

Today, wind and solar power purchase agreement (PPA) prices range from $53 to $153/MWh in those markets.

The production of hydrogen, used in industries as diverse as oil refining, steel manufacturing, and ammonia and methanol production, is carbon-intensive. In 2017, hydrogen production resulted in 830 metric tons of carbon emissions, greater than the annual emissions pumped out by the entire nation of Germany (797 metric tons) or the 677 metric tons attributed annually by the global shipping sector.

Wood Mackenzie’s research shows that less than 1 percent of all hydrogen produced today comes from renewable electricity, relying instead on natural gas and coal.

Switching to hydrogen produced by wind and solar via electrolysis, which splits water molecules into hydrogen and oxygen atoms, offers a significant opportunity to decarbonize its production and reach emissions targets.

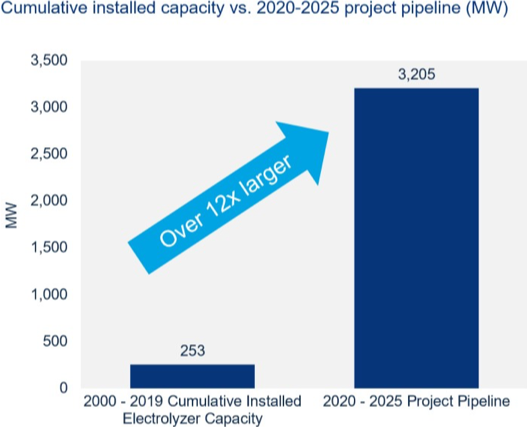

According to Wood Mackenzie, from 2000 to the end of 2019, 252 MW of green hydrogen projects will have been deployed worldwide. By 2025, this will increase by 1,272 percent, with the deployment of a further 3,205 MW of electrolyzers dedicated to green hydrogen production.

“The large increase in the 2019-2025 period is partially due to the nascency of the market,” said Ben Gallagher, a senior analyst at Wood Mackenzie. “But aggressive targets in East Asia and increased interest from major international stakeholders will drive deployment in the near term.

“While cost-competitiveness might be out of reach in most scenarios by 2025, national targets and pilot projects will produce enough volume to realize substantial capex declines beyond 2025,” he said.

Gallagher said that as renewable energy deployment grows, so too will the green hydrogen market.

But there are challenges. While green hydrogen has made gains in a number of key markets, including Japan, Germany, and Australia, at present it cannot compete with the low costs of locally produced coal and natural gas-produced hydrogen in China and the U.S., for example.

On top of this, it remains unclear if renewable PPA prices worldwide will fall fast enough to make green hydrogen production competitive.

However, Gallagher is optimistic about the green hydrogen sector’s future.

“We are just embarking on the energy transition,” he said. “There are several unknowns that would further spur adoption of green hydrogen: changing policy dynamics, new carbon regimes, new ways to monetize grid flexibility, and lower-than-expected costs of renewables.”

MORE INFO www.woodmac.com